What is COE (Close of Escrow) in real estate- Understanding The Importance of COE

In real estate, the term "Close of Escrow" typically means "COE." It describes the day that the buyer and seller officially become the property's owners after completing all necessary paperwork for the purchase. In this cycle, cash is traded, contracts are marked, and the exchange is enlisted with important government organizations. The COE date is significant because it indicates the completion of the transaction. When the buyer takes ownership of the property.

Property exchanges can be troublesome and confounding, with a ton of language and specialized phrases utilized. The expression "close of escrow," or COE, is much of the time utilized in land exchanges. This blog is for you assuming you need to be more knowledgeable about its significance or significance. We will investigate the COE in land exhaustively, its significance, and how the cycle happens.

What does the COE mean in real estate?

COE stands for Close of Escrow in real estate. It’s the time when a property sale is finalized and privilege transfers from the seller to the buyer. The contract of purchase specifies the COE date, which marks the completion of the escrow period during which the buyer's payments remain in reserve until the fulfillment of all selling requirements. Usually, at COE, the seller receives the money while the buyer receives the keys.

In other words, COE indicates the moment at which the home buyer acquires the right to use and possess the property and the owner of the house forfeits the title and ownership of the property.

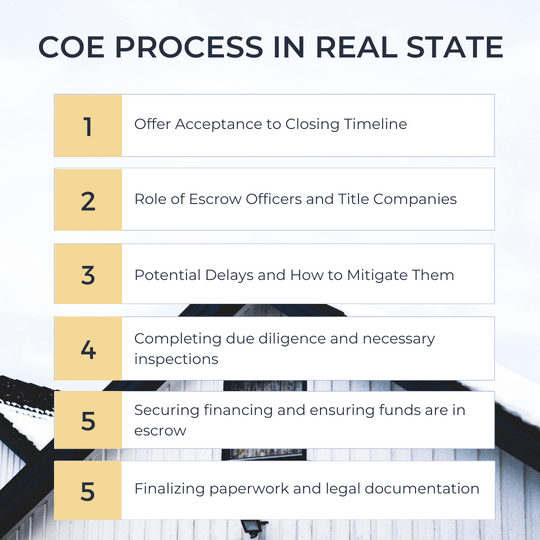

Understanding the COE Process in Real State

Offer Acceptance to Closing Timeline:

There are usually a few weeks between the acceptance of the offer and the closure of escrow (COE). Following an acceptance of an offer, the buyer often initiates the due diligence process, which may involve financing arrangements, inspections, and appraisals, as well as placing earnest money into escrow. The seller may also take care of any contingencies mentioned in the purchase agreement at this point. Following the satisfaction of all requirements, the parties move forward to the closing step, where money is exchanged, legal paperwork is completed, and the ownership of the property is passed from the seller to the buyer.

Role of Escrow Officers and Title Companies:

Escrow agents are essential in helping to make the COE process easier. They manage the money and document exchanges between the buyer, seller, and lender as impartial third parties. To safeguard the buyer and lender from any unforeseen legal complications, title companies make sure that the property's title is free of any liens or encumbrances and provide title insurance.

Potential Delays and How to Mitigate Them:

There are several reasons why the COE process can take longer than expected, including problems with funding, missed contingencies, and documentation errors. It is imperative that all parties involved maintain organization, communicate well, and take swift action to resolve any concerns to minimize delays. Proactive actions can assist keep the transaction moving forward and guarantee a fast COE. Examples of these actions include finishing inspections early and delivering necessary documentation right away.

Preparing COE in real estate in an easy way

Several essential steps must be taken in advance of COE to guarantee a seamless closure procedure. This includes settling any escrow issues or inspections, performing due diligence, arranging financing, and liaising with title firms and escrow officers. In real estate transactions, efficient preparation is essential to reducing delays and guaranteeing a successful escrow closing.

Completing due diligence and necessary inspections

To find any possible problems with the property before the COE date, it is necessary to do the required inspections and due investigation. This includes looking over pertinent paperwork, including property reports and disclosures, and performing an in-depth examination of the property to find any structural or maintenance issues.

Securing financing and ensuring funds are in escrow

One more essential component of getting ready for COE is getting financing and making certain money is in escrow. To complete their mortgage arrangements and guarantee that the required money is placed into the escrow account before the COE date, buyers must collaborate closely with their lenders. This guarantees that all necessary funds are available for the transaction to go through without a hitch.

Finalizing paperwork and legal documentation

Completing all essential paperwork and legal documentation for the real estate transaction is known as "finalizing paperwork and legal documentation." This entails signing the title documents, purchase agreement, and any other contracts or declarations mandated by regional laws. A successful COE and a smooth transition of ownership from seller to buyer depend on the papers being completed accurately.

Types of COE- Get All You Must Know

Buyers and sellers need to get the COE distinctions as they can influence their rights and responsibilities during the transaction.

COE can be of different types, but the major three are:

● Actual COE: The precise day and hour of ownership transfer are indicated by the actual COE.

● Constructive COE: Assumes that ownership will transfer on a specific date, even if it does so later.

● Equitable COE: Upon fulfillment of contract conditions, transfers equitable title to the buyer before legal ownership transfer.

Importance of timely COE in real estate

For several reasons, COE is important in real estate. First of all, it completes the deal and signifies the formal conclusion of the sales process. Second, it represents the change in ownership. After the recording is confirmed, the buyer receives the keys, and the title is formally transferred to the County Recorder's Office. Finally, it entails the distribution of money by the Final Settlement Statement and the escrow instructions. It guarantees that the money is distributed to all pertinent parties.

Making additional life plans, completing your loan, and organizing your move all depend on knowing the COE date. Always get advice from your real estate lawyer or agent to learn the precise legal criteria for COE.

Timely Close of Escrow (COE) is crucial for various reasons in real estate transactions.

Avoiding contract breaches and legal complications:

Failing the COE deadline may result in breaches of contract, which could cause problems for the buyer and seller legally and possibly lead to conflicts. A timely COE minimizes the possibility of legal issues by ensuring that both parties follow the provisions of the agreement.

Ensuring a smooth transition of ownership and possession:

The smooth transfer of title and possession of the property from the seller to the buyer is made possible by timely COE. It minimizes interruptions and ambiguity during the transition process by ensuring that the buyer can take control of the property as promised.

Meeting contractual obligations to all parties involved:

When it comes to meeting contractual responsibilities to buyers, sellers, lenders, and real estate brokers, timely COE shows integrity and competence. It increases the satisfaction of all parties involved in the deal by establishing confidence and trust in it.

Potential Challenges and Solutions for an Agent

Potential challenges may arise during the COE process, but proactive measures can help mitigate them effectively.

Issues with title searches, liens, or encumbrances: The COE may be delayed if search results turn up anticipated liens or encumbrances on the property. To mitigate potential risks, it is advisable to seek title insurance and collaborate with seasoned escrow officers and title businesses to quickly address title difficulties.

Financing delays or complications: The COE schedule may be hampered by financial problems including financial difficulties or delays in loan approval. Purchasers can lessen this by getting pre-approved, submitting all necessary paperwork on time, and keeping lines of communication open with their lender to quickly resolve any potential issues.

Strategies for resolving disputes or discrepancies: Delays in the COE may result from disputes or inconsistencies amongst parties to the deal. To ensure that the COE process proceeds well and that any concerns are resolved promptly, effective communication, negotiation, and mediation can assist resolve conflicts peacefully. Having legal counsel on hand can also help to resolve more complicated conflicts by offering advice and support.

Importance of proper preparation and communication for COE in real state

Proper preparation and communication are vital for a successful close of escrow (COE) in real estate transactions, ensuring a smooth and timely process.

Minimize Delays: Time for resolution is maximized when possible problems are detected early on thanks to adequate preparation. Before the COE date, this entails completing due diligence, obtaining funding, and taking care of any lingering problems.

Legal Compliance: Being well-prepared lowers the possibility of contract violations or other legal issues by guaranteeing that all legal criteria are satisfied. To ensure compliance with legal requirements and contractual commitments, this entails compiling and reviewing the relevant documentation, such as purchase agreements, title documents, and disclosures.

Clear Communication: For a COE to be successful, there must be effective communication between all parties involved, including buyers, sellers, agents, lenders, escrow officers, and title companies. By doing this, it is made sure that everyone is aware of their roles, deadlines, and any updates or modifications that may occur along the process.

Managing Expectations: Effective communication minimizes miscommunication and aids in the management of expectations. To enable a smoother transaction, buyers and sellers should be informed of the COE timetable, potential obstacles, and the processes required.

Effective planning and communication are essential to a successful COE, reducing delays and risks and guaranteeing a favorable experience for every party engaged in the real estate transaction.

How does COE impact homeownership costs?

The Close of Escrow in a real estate deal can affect property taxes and ongoing costs of property ownership in several ways:

Property taxes: Depending on the length of the tax year and local rates, the buyer often pays their portion of the property taxes starting on the COE date.

Homeowners insurance: Buyers have to ensure homeowners insurance by the COE date, as it marks the start of the coverage period, especially if they’re investing in the purchase.

Homeowner association fees: Buyers of properties in homeowner associations (HOAs) are responsible for paying their share of dues and fees, which include monthly dues and special levies, as of the COE date.

Utilities: To prevent problems, buyers must move utilities into their names and pay up any outstanding debts before the COE date.

What happens on the Close of Escrow day?

Both buyers and sellers will have to sign several paperwork on the day of the COE, including the loan documentation, bill of sale, and deed. Usually, the escrow company receives money from the buyer's lender, and the seller is paid. Before completing the deal, the escrow company makes sure all the funds are in and the paperwork is signed. After the COE, documents like the deed are registered with the county or municipal government. Depending on the conditions of the purchase agreement, possession of the property may pass instantly or later.

How many documents are involved in the COE process?

The parties sign several key documents. These include:

● A final statement that includes a summary of the costs and purchase price.

● a document that gives the buyer ownership over the seller.

● A bill of sale that lists personal belongings, including household appliances.

● Settlement statement that documents the money exchanged at closure.

● loan documentation if the buyer is using a mortgage on a house.

● The buyer is protected against title flaws after the sale by a title insurance policy.

● escrow instructions that give the escrow agent direction when managing transfers of property and money.

What to do when either the buyer or seller overshoots the COE date?

To reduce the possibility of negative legal or financial repercussions, both parties must prioritize fulfilling the COE date and efficiently communicate with one another. There could be various consequences if any of the parties miss the important date:

Default: The seller may terminate the contract and keep the earnest money deposit (EMD) if the buyer fails to meet the COE. The buyer demonstrates their serious interest in buying the property with this deposit, which is kept in an escrow account until the sale closes.

Extension: If both sides agree, the COE date may be extended; however, this will necessitate changes and more documentation.

Penalties: The agreement may specify fines or penalties for missing COE.

Litigation: Legal action or relative law enforcement may occur if one party believes the other breached the agreement.

Negotiation: Parties may negotiate to recover the deal despite the missed COE, perhaps by adjusting fees or the deal price.

What is the main reason for the potential delay in closing the escrow account?

Buyers and sellers should cooperate closely with their real estate agents, lenders, and other specialists to identify and address potential issues early to minimize COE uncertainties.

These delays could be due to several causes. Get a clear idea of the real estate business here.

● Financing issues: The borrower may face difficulties securing financing. Or, the loan lender may request additional documentation.

● Home assessment issues: Problems found during home assessments may need negotiation and repair.

● Title issues: Clearing title problems such as liens or easements could delay COE.

● Contingencies: Determining home sale contingencies concerning selling the buyer’s present home may take time.

● Paperwork delays: Signing loan papers or other paperwork delays could push the COE date.

● Natural disasters or unexpected events: Events such as cyclones or earthquakes may affect the property and could cause COE delays.

FAQs

Concerning COE, when should a buyer perform a home inspection?

A final walk-through must be scheduled by a house buyer five to seven days before the COE. Any repairs or alterations made after the purchase agreement was completed are noted by the real estate agent. It's crucial to complete the last property walkthrough. Before completing the transaction, it makes sure all agreed-upon repairs are finished and the property is as described.

When is COE generally scheduled in a real estate deal?

COE usually occurs when all conditions in the purchase contract are met, and funds are deposited into the escrow account. It usually ensues within 30 to 45 days after signing the agreement.

What is the typical duration of the COE procedure in real estate?

COE processes normally take 30 to 45 days, though this can change depending on the details of each transaction.

What distinguishes COE from the closure date?

Similar in nature, the COE is the day the transaction is completed and recorded, whereas the closure date is the date specified in the contract.

During a real estate purchase, who manages COE?

Coordination of COEs is usually handled by escrow agents and/or real estate attorneys, with support from lenders and real estate agents.

What Listing Genie Offers

Listing Genie provides a comprehensive suite of content creation services tailored specifically for real estate agents.